Allianz Care Australia

Allianz Care Australia

CBHS International Health

CBHS International Health

If you need to lose a lot of weight for your health, and eating well and exercise haven’t worked, you might be considering surgery. In 2014-15 (the latest statistics available) there were around 22,700 hospitalisations for weight loss surgery procedures in Australia – a number that’s more than doubled since 2005-06 – with 7 out of every 8 procedures done in a private hospital. Gastric band, gastric sleeve and gastric bypass procedures are all types of weight loss surgery covered by health insurance. However not all of your costs will be covered, and you’ll have to meet certain conditions to be eligible for cover, so it’s important to do your homework first. Here’s what you need to know, including how to find the cheapest health insurance for weight loss surgery in Australia.

Does health insurance cover weight loss surgery?

Weight loss surgery is covered by private health insurance but only on the most expensive levels of Hospital Cover – the Gold and Silver Plus tiers.

To be eligible to claim for weight loss surgery, most insurers will require you to have a BMI of 35 plus and a health condition, meaning the surgery is medically necessary (and not for cosmetic reasons). If you’re upgrading your cover, or changing to a new insurer with a higher tier of policy, you may have to serve a 12-month waiting period for weight loss surgery claims. Make sure your doctor gives you a full rundown of costs, and check with your insurer about how much is covered.

What does each Hospital Cover tier cover?

You could choose to do the surgery in a public hospital under Medicare, which means the procedure will be free, however you may face long waiting periods.

Regardless of whether it’s done in a public or private hospital, weight loss surgery is only performed for health (not cosmetic) reasons.

What’s the cheapest health insurance for weight loss surgery in Australia?

The cheapest policy for weight loss surgery we could find for a single adult in Victoria with no children was $265.01 per month for a Silver Plus policy (Hospital Cover only).

Depending on your policy, you may need to pay an excess and a Gap, so check the policy conditions before you sign up, and get a full rundown of costs from your doctor. According to Medical Costs Finder, the average out-of-pocket cost for people having gastric bypass in a private hospital in 2022-23 was $990.

Does health insurance cover Ozempic?

Weight loss drugs such as Ozempic, Wegovy and Saxenda are covered on Extras policies that include the Non-PBS Pharmaceuticals category, however the level of rebate varies between insurers. For example, HBF lowered its rebate for Ozempic in 2024.

If Ozempic is prescribed for diabetes, it’s subsidised on the Pharmaceutical Benefits Scheme but not when used for weight loss.

The cheapest Extras policy we could find that included Non-PBS Pharmaceuticals for one adult with no children in Queensland was $50.18 a month.

What’s the best health insurance for weight loss surgery?

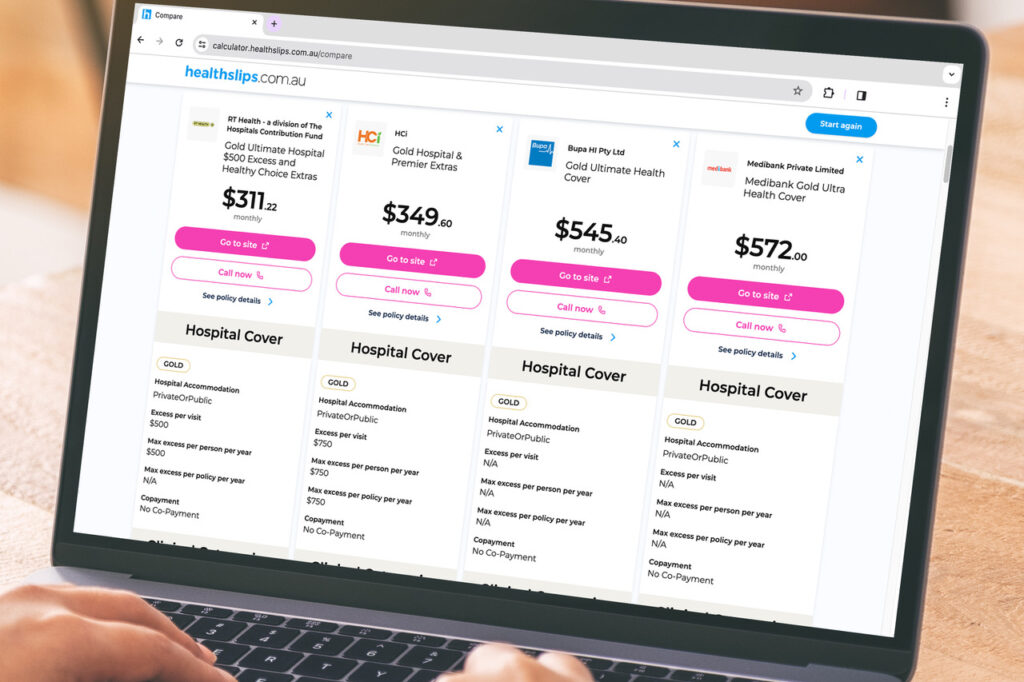

To find the best health insurance for weight loss surgery, use the healthslips.com.au Calculator to make sure you’re searching across every single policy available. Remember to tailor your options in our Calculator to include ‘weight loss surgery’ under Hospital Cover, or if you’re looking for cover for weight loss drugs such as Ozempic, make sure your search includes ‘Non PBS Pharmaceuticals’ under Extras Cover.

And if you’re worried about being pressured to buy, don’t be – we don’t ask for your personal details, and we don’t sell insurance, so you can search for policies freely. It’s the fastest, most comprehensive way to find the best health insurance in Australia for you.

Try the healthslips.com.au Calculator or compare your existing policy against other policies.

Knowledge is power – that’s the guiding principle behind everything Trudie writes, and it’s a philosophy she brings to her work at healthslips.com.au. By breaking down complex information into easy-to-understand blogs and stories, she aims to empower Australians to make the best choices and an informed decision around private health insurance.

Trudie understands firsthand some of the complexity of private health insurance having moved to Australia from New Zealand and having to navigate a vastly different public healthcare system and health insurance structure.

Trudie holds a Bachelor of Communication Studies (journalism major) from the Auckland University of Technology.