Allianz Care Australia

Allianz Care Australia

The whole point of taking out health insurance is to reduce your health costs, so it can come as a bit of a shock to get a bill for medical treatments that are covered by your policy. Even though private health insurance covers you for certain health treatments, sometimes doctors and hospitals will charge more than what your insurer (and Medicare) will pay. That’s known as a Gap or out-of-pocket fee, and you can’t claim it on your policy.

So, what is the Gap in private health insurance? When you’re treated in hospital as a private patient, depending on your policy, doctor and place of treatment, you might pay:

- no Gap

- a ‘known Gap’, which applies if your insurer has an agreement with your doctor or hospital to only charge a set amount out of pocket

- a Gap (the amount of Gap payments in Australia will depend on the doctor and/or hospital).

Here’s how to lower your chances of paying a Gap.

What is the Gap in private health insurance?

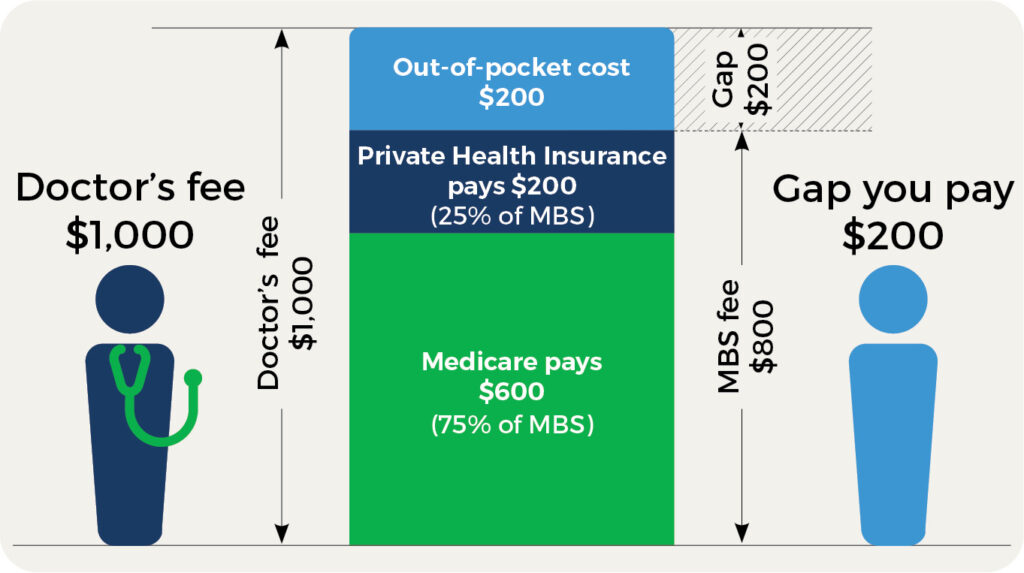

A Gap is the difference between what your doctors or hospital charge, and what your health insurer and Medicare combined will cover. Gaps happen because Medicare can only cover 75% of the Medicare Benefits Schedule Fee (MBS) for treatment and health insurers are only allowed to pay the remaining 25% – but doctors and hospitals are allowed to charge more than the MBS Fee. So if your doctor or hospital is charging more than the MBS Fee, you’ll have to pay the difference.

What are the different types of Gaps for private hospital treatment?

There are 2 types of Gaps for private hospital treatment:

- Hospital Gap – if you’re admitted to hospital as a private patient, a Hospital Gap is the difference between what the hospital charges for accommodation, meals and time in theatre, and how much your insurer and Medicare combined will cover.

- Medical Gap – if you’re treated by a doctor or specialist as a private patient (either in a private hospital or as a private patient in a public hospital), a Medical Gap is the difference between what your doctor or specialists charge for their services and what your health insurer and Medicare combined will pay.

Gaps may also apply for out-of-hospital treatments, including appointments with dentists, allied health professionals and GPs.

When do I have to pay a Gap?

You may have to pay a Gap if you’re treated as a private patient in hospital (as explained above), or you receive:

Extras Cover treatments

If you have Extras Cover and you’re treated by a dentist or an allied health professional such as a physiotherapist and chiropractor, you’ll pay a Gap. Your Gap will be the difference between what the healthcare professional charges and the amount your health insurer will cover. If you don’t have Extras Cover, you’ll pay the full amount that your allied health professional charges.

GP consultations

If your GP doesn’t bulk bill, you will pay a Gap. Your Gap will be the difference between what Medicare pays and what your GP charges. You cannot use health insurance for this cost (by law, health insurance can’t cover GP appointments).

Paying a Gap for physio treatment

Shannon, 35, needs physiotherapy for an ankle injury. Her physio charges $115 per consultation, but her health insurer will only cover $49 per appointment, leaving her to pay a Gap of $66.

| Cost of consultation | Insurance claim | Gap |

| $115 | $49 | $66 |

Paying a Gap for hospital treatment

Matteo, 61, needs a partial knee replacement. He has Hospital Cover at Silver Plus tier, which includes the Joint Replacement clinical category, so he decides to skip waiting lists by opting for private hospital treatment. His surgeon, Dr C, informs him the charge is $4,500 for this treatment. Medicare will pay $1,900 and Matteo’s insurer will pay $1,800, leaving Matteo with a Medical Gap of $800. His insurer has a No Gap agreement with the hospital which means he does not have a Hospital Gap for hospital services (including accommodation).

| Cost of treatment (incl specialist fees) | MBS Fee amount | Medicare rebate | Insurance claim | Gap |

| $4,500 | $3,700 | $1,900 | $1,800 | $800 |

How can I avoid or lower the Gap for hospital treatment?

If you need to be admitted to hospital for non-urgent treatment and you decide to go to a private hospital, or to be treated as a private patient in a public hospital, ask whether your doctors have a Gap agreement with your health insurer. Make sure they will honour that agreement, as some might choose not to – so it’s best to ask for a breakdown of the out-of-pocket costs in writing. Also check whether the hospital has an agreement with your insurer.

If there is a Medical Gap or Hospital Gap, contact your insurer to find out whether they have a Gap or known Gap agreement with alternative healthcare providers or hospitals, so you can lower your out-of-pocket costs by choosing a different doctor and/or hospital.

How do I find a better health insurance policy?

If your health insurance policy doesn’t reduce your healthcare costs as much as you’d like, look for one that does. The easiest and fastest way to make sure you don’t miss out on the best health insurance policy is to use the healthslips.com.au Calculator, which compares every policy available. We leave no stone unturned to give you all the options, personalised to your needs, and since we don’t sell insurance it’s all completely unbiased. You don’t have to enter any contact details and it’s free to use.

Try the healthslips.com.au Calculator.

Knowledge is power – that’s the guiding principle behind everything Trudie writes, and it’s a philosophy she brings to her work at healthslips.com.au. By breaking down complex information into easy-to-understand blogs and stories, she aims to empower Australians to make the best choices and an informed decision around private health insurance.

Trudie understands firsthand some of the complexity of private health insurance having moved to Australia from New Zealand and having to navigate a vastly different public healthcare system and health insurance structure.

Trudie holds a Bachelor of Communication Studies (journalism major) from the Auckland University of Technology.